Growegy Net 30 Business Suite Account Overview

About Company

Growegy offers a suite of AI-powered business tools designed to help small businesses plan marketing campaigns, create promotional content, build business plans, find the right funding, manage tasks and workflows, all while building their business credit with net 30 terms. Customers receive access to a dedicated account manager with included monthly one-on-one consultations and additional complimentary agency services as a part of the loyalty benefits program.

Is a Growegy Net 30 Account Worth It?

Growegy is here to help you with growth and strategy for small and medium business owners. Our account managers help companies integrate their business into the software platform to get the most out of it. During consultations they can go over software demos and help you with your business strategy!

The Small Business Administration reports the most common reasons small businesses fail include a lack of capital or funding, retaining an inadequate management team, a faulty infrastructure or business model, and unsuccessful marketing initiatives.

Growegy addresses 3 of the 4 reasons that businesses fail.

- Business Credit Building: With Growegy net 30 terms, we help small businesses build the transaction history needed to show legitimacy. Paying your invoicing on time or a bit early sets you up for continued success in obtaining lending. We work with Experian Business and Equifax Business credit bureaus to automatically report transaction history, building out your credit profile for future lenders. With the use of our funding feature we can help you identify which funding you may qualify for and a path forward for the ones you don’t qualify for yet.

- Tailored Content AI Generation: AI saves your business time and money, it is always ready to write your first drafts, find information, or create promotional campaigns, so you can spend time on higher level tasks. Many of the business owners we work with don’t know how to get started with social media and struggle to keep their accounts active. Between our AI and the Account Manager’s guidance, we have you covered! Our AI is unique, adding in your personalized business details to share with our AI so content is always on brand and using the right tone for your audience.

- Business Management: Growegy provides a Business Plan AI generation, project management calendar, a dedicated account manager, and marketing agency services to ensure your business can launch promotions and get discovered. Additionally, we offer built in analytics for your marketing campaigns to help you identify what’s working for your company and where you are wasting time and money.

Growegy automatically reports business credit to Equifax Business and Experian Business on a monthly basis.

Growegy has been featured in the NET 30 guides of several industry leaders, including Nav, TRUiC, Startup Savant, and FairFigure. Since 2020, we have proudly served over 5,000 businesses.

Growegy Net 30 Account Pros

Available to New and Established Businesses. Growegy has a quick and easy approval process for net 30 applications. Growegy will complete the review and account creation within 2 business days (48 hours) from application submission. There is no personal guarantee or personal credit check involved. Automatic credit reporting commences as soon as you provide your Tax ID or EIN Number.

Growegy offers All-In-One product (Net 30 Business Suite) that includes:

1. Business Credit: Growegy issues invoices on net 30 terms and reports monthly to Experian and Equifax.

2. Business Plans: Business credit scores are a start, but obtaining a loan requires more than making payments on time. Our customizable business plans, complete with financial analysis and projections, help ensure you are better positioned for future funding opportunities and keep your team aligned with your company’s goals.

3. Content AI Generation: Growegy’s AI is unique, offering personalization for your specific business, allowing AI to get a better understanding of your business and provide you with more comprehensive results. If you don’t know how to use AI for your business, Growegy has you covered with the library of preset prompts to get you started and access to a dedicated Account Manager that can meet with you so you can do it together. Use it to create your first draft for your content, look up best practices, create marketing schedules and even to help you optimize your SEO.

4. Business Management: We offer a project management calendar, a dedicated account manager providing one on one consultations, and marketing agency services, in the form of free loyalty benefits as well as add on services,to ensure your business can launch promotions and get discovered. Your account manager can help you to set and maintain goals within our system, ensuring that your business continues to move forward.

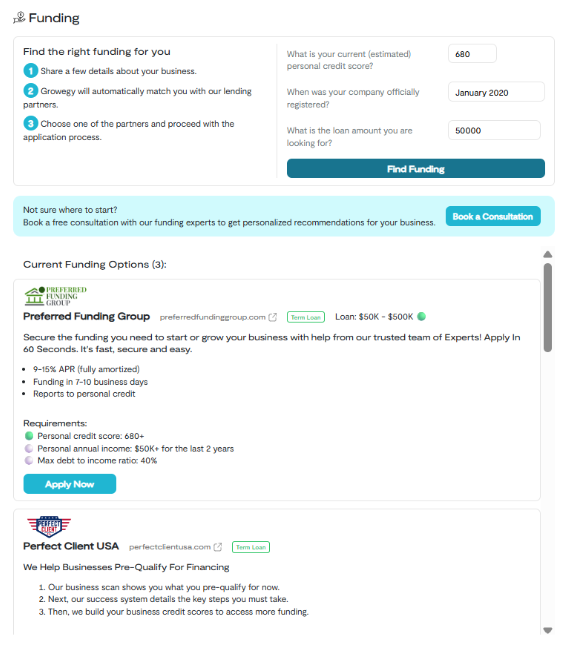

5. Funding: Growegy’s Funding feature allows you to answer a few quick questions and get matched with potential funding opportunities without any impact to your credit scores. Each match provided gives you details about other qualifications you may need to meet, shows you which qualifications you did meet, and provides you with some information about the lender. From traditional SBA loans to more creative financing, allow us to help you find the funding your business deserves. Not sure what to do with your results? Schedule a free funding consultation to go over the results together and plan a path forward with your account manager.

6. Marketplace: Growegy offers a curated selection of partner services tailored specifically for small businesses, featuring exclusive bonuses and discounts for Growegy users, to enhance your experience.

7. Growegy on the Go! Growegy has launched a mobile application designed to enhance your experience! Additionally, you can sign up for text reminders about the due dates for net 30 invoices, ensuring you never miss a payment.

Additional Purchases:

Growegy also provides you with the option to purchase additional agency services, helping you with your company’s SEO, content creation, social media management and more! All purchases are invoiced on Net 30 terms and help to increase your reported credit limit.

Growegy Net 30 Account Credit Reporting

Growegy automatically reports every month to the following credit bureaus:

- Experian Business

- Equifax Business

Growegy reports data to the bureaus regardless of when you pay (early, on-time, late) but only begins positive reporting once you have provided your EIN. The minimum monthly cost is $55 for access to the software and account manager. You can save money on an annual plan which is $600 in total, spread over three payments in consecutive months.

Growegy sends the report to the bureaus the next business day after 14th each month, however, the close date for the reports is on the 14th. If you have an open invoice on your account at 11:59 PM PACIFIC TIME on the 14th of the month it will report as a balance on the account. Having a balance on your account at the time of reporting can increase your credit utilization and temporarily lower your business credit score.

To avoid increased credit utilization, please make sure you login to your account on the 14th of each month before 11:59 PM PACIFIC TIME and pay all outstanding invoices.

It is ok to pay your account with Growegy early, we will still send out the reports on your account.

For long-term strategy, explore The Best Net 30 Account for Long Term Success to see how vendors report to bureaus.

Growegy Net 30 Account Loyalty Benefits

Growegy Net 30 account has a great loyalty program that every user is automatically enrolled in at no additional cost. It is designed to support Small Business Owners. Whether you opt for the annual or monthly subscription, benefits are tailored to elevate your brand and win more customers.

𝗟𝗼𝘆𝗮𝗹𝘁𝘆 𝗣𝗿𝗼𝗴𝗿𝗮𝗺 𝗕𝗲𝗻𝗲𝗳𝗶𝘁𝘀:

- Ready-to-use social/paid ad copy & eye-catching images providing you with all the content you’ll need to upload and run your ad on the platform of your choice

- Comprehensive SEO Technical Review to optimize your site and improve visibility

- Choose 5 engraved bottle openers or metal business cards—perfect for networking events

- In-depth website design review & recommendations – ensure that your visitors have an optimized experience and that your website is sending the right message to your potential clients

- SEO content review with keyword suggestions to boost your search rankings; compare your keywords to your top competitors and increase your ranking on keyword search results

- Advertising account setup to kickstart your marketing campaigns. Google Advertising accounts can be difficult to get set up and approved, let us do the hard work for you!

𝗛𝗲𝗿𝗲’𝘀 𝘄𝗵𝗲𝗻 𝘆𝗼𝘂 𝗴𝗲𝘁 𝘁𝗵𝗲𝗺:

- Annual Net 30 P𝗹𝗮𝗻: Instant access to several benefits, with access to ALL benefits by month three!

- Monthly Net 30 P𝗹𝗮𝗻: Start enjoying benefits from the 5th month of subscription.

You can find more information in the Loyalty Benefits overview.

Growegy Net 30 Approval Requirements

To qualify for a net 30 account with Growegy you will need to provide a valid phone number, email address, registered business name, business address, and principal name. In addition to this, Growegy will verify the business EIN for regular business credit reporting, although it is not a prerequisite to opening the account itself.

There is no personal guarantee or personal credit check involved.

Net 30 Application link – https://growegy.com/small-business/net30-application/

You can choose from two different net 30 plans – Annual Plan and Monthly Plan.

- MONTHLY. $55 / month. Monthly Billing, cancel any time.

- ANNUAL. Make 3 interest-free payments (invoiced over 3 months). $200 per payment, then $0 for the rest of the year. Annual contract, cancellations will go into effect at the end of your contractual year.

Monthly or Annual: Which Should You Choose?

Growegy’s monthly plan is billed on a month to month basis, meaning you can cancel this plan any time and are only in a monthly contract with us and the account will cancel on the following billing cycle. Our monthly account is $55 per month and the account is automatically billed each month until you cancel. You receive access to all the features and benefits of the account but loyalty benefits do not begin to accrue until months five through twelve. When it comes to Growegy’s AI, a lighter version of the AI is available to monthly subscribers. The reported credit limit on Growegy’s monthly account is $220.

Growegy’s annual plan is billed on an annual contract and split into three invoiced payments of $200 each, making the total cost for the year $600 – making this plan cheaper than our monthly option. These invoices are sent once per month in the first three months of service and then the account is paid in full. Growegy allows a one cancellation period in which you may request to cancel this contract and void the invoices, after that you are in contract with Growegy for the duration of the 12 months you signed up for. The annual account provides a more advanced version of our AI, processing results much faster. Loyalty benefits start becoming available after the first payment is made and by the time you make your third payment all benefits are available. The annual account reports a credit limit of $600 and even though you only make three payments, we send credit reports for all twelve months that you are a client with Growegy.

Apply today—no personal guarantee or credit check required.

Follow Us

Download

© 2020-2026 Growegy. All rights reserved.

Growegy is not a credit repair organization, financial advisor, financial planner, investment advisor, tax preparer, or acting as a fiduciary, as those or similar terms may be defined under federal or state law. Growegy makes recommendations you may find helpful. Growegy reports business tradelines to business credit bureaus. It is up to you to make the final decision about what is in your and your business’s financial interest.