Maximize Your Business Growth and Business Credit Scores with Fairfigure's Business Credit Card and Growegy

In the challenging world of business, finding reliable pathways to growth and funding can be a game-changer. Many business owners struggle to find credit solutions that won’t impact their personal credit but will still grow their scores. At Growegy, we specialize in providing everything you need to elevate your business—be it through promotional products, AI-driven marketing content, or tailored strategy meetings.

Today, we’re excited to introduce a powerful new tool to complement our offerings: Fairfigure’s Business Credit Card. Designed to boost your productivity and strategically position your company for funding, this card allows you to build business credit efficiently while safeguarding your personal credit.

Why Fairfigure?

Fairfigure’s Business Credit Card is a revolutionary product for entrepreneurs and small business owners. It offers an EIN-only application process, ensuring your personal credit remains untouched. Here’s a quick rundown of the unparalleled benefits it provides:

- EIN-Only Application: There’s no impact on your personal credit. A key feature that distinguishes Fairfigure from traditional business credit cards.

- No Hard Inquiries: Applying for the Fairfigure card won’t affect your credit history, giving you peace of mind.

- Reports to Multiple Bureaus: Payments are reported to Equifax, Experian, the SBFE, Creditsafe, and Fairfigure’s own Foundation Report. This robust reporting enhances your business’s credit reliability and attractiveness to future lenders.

- Simple Eligibility Requirements: Just ensure a positive bank account balance, at least $2,500 per month in revenue for the last three months, and possess an EIN. Only your EIN documents and bank statements are required.

- Flexible, No-Fee Structure: With no monthly or annual fees, and the option to repay in 4 or 8 weeks without hidden charges, your financial planning can stay focused on growth, not expenses.

Optimize Your Assets with Growegy

Embrace an effective strategy to maximize your purchasing power.

Use your Fairfigure’s Business Card to pay your Growegy invoices. Not only does the invoice payment report to the business bureaus, but the card payment does too—giving you two credit reports for one transaction.

By aligning your payments through a reporting business card, you secure dual reporting benefits. This means each payment not only enhances your business credit profile with Fairfigure but also extends its impact through Growegy’s network, effectively maximizing your credit score potential.

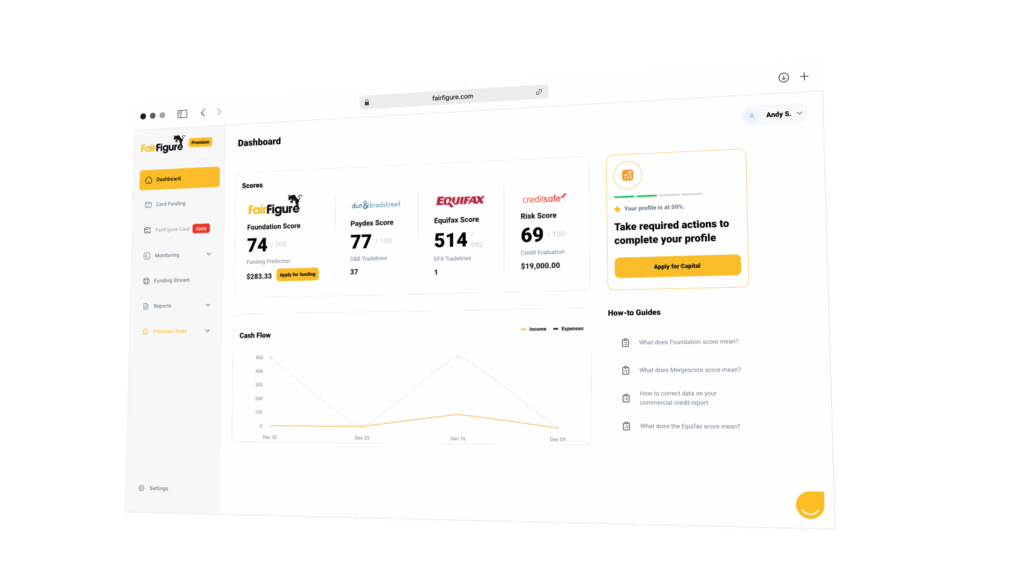

Credit Monitoring: Stay Informed

Knowledge is power and everyone should be monitoring their credit reports. For those interested in an ongoing insight into your credit status, Fairfigure offers optional credit monitoring at $35/month, providing access to your comprehensive reports at Dun & Bradstreet, Equifax, and Creditsafe. There is also a free option, providing you with access to Creditsafe reports, giving you a sneak peek into your credit health, which is crucial for strategic planning and funding opportunities.

The Path Forward

At Growegy, we believe in empowering businesses to reach their full potential. Opening a Fairfigure’s Business Credit Card is more than just accessing a financial tool; it is a strategic step towards growth, financial independence, and robust creditworthiness. Use it smartly by incorporating it into your Growegy services, enhancing your purchasing power, and accelerating your progress towards building a strong, independent business credit profile.

Join us in aligning your financial strategies with innovative tools that propel your business towards greater heights. Apply for Fairfigure’s Business Credit Card today and use it to pay your invoices at Growegy. Open a world of possibilities for your enterprise—and remember, with Growegy, you have everything you need to grow your business and secure your funding future.

Follow Us

Download

© 2020-2026 Growegy. All rights reserved.

Growegy is not a credit repair organization, financial advisor, financial planner, investment advisor, tax preparer, or acting as a fiduciary, as those or similar terms may be defined under federal or state law. Growegy makes recommendations you may find helpful. Growegy reports business tradelines to business credit bureaus. It is up to you to make the final decision about what is in your and your business’s financial interest.