Experian’s Business Credit Score: Intelliscore Plus

In ecosystem of the business world, understanding your financial health is crucial, especially when you’re charting pathways for growth and seeking funding to propel your small business. We know that building a robust business credit history is paramount, and a pivotal element in that journey is grasping the nature and significance of your business credit score, specifically the Experian Intelliscore Plus.

The Basics of Intelliscore Plus

The Experian Business Credit Score, or Intelliscore Plus, ranges from 1 to 100, with higher scores signifying lower risk. It’s a critical metric lenders, suppliers, and partners leverage to assess the creditworthiness of your enterprise. A high Intelliscore can translate into better loan terms, lower insurance premiums, and more favorable trade agreements, whereas a poor score may pose challenges in securing funding and beneficial terms.

What Contributes to Your Intelliscore Plus?

Understanding the components of the Intelliscore is vital. The score is crafted using a blend of several factors:

- Credit Habits and Obligations: Information from your suppliers and lenders concerning trade experiences, outstanding balances, payment behaviors, credit utilization, and trends over time play a significant role in shaping your score.

- Public Records: The presence, recency, frequency, and amounts associated with any liens, judgments, or bankruptcies directly affect your score. Legal filings from local, county, and state courts are part of this consideration.

- Demographics and Business-specific Data: Years on file, your Standard Industrial Classification (SIC) code, and the size of your business are demographic indicators factored into your score. Comparative data places your payment behavior in context, assessing how you fare alongside industry peers.

- Company Background: This includes information collected from independent sources, such as state filing offices, public records, credit card companies, collection agencies, corporate financial information, and marketing databases.

Why Does Your Intelliscore Matter?

Unlike personal credit scores, your business credit score is public. This visibility means anyone—be it potential lenders, partners, or even competitors—can check your company’s credit profile at any time. Maintaining a strong business credit score is not merely about borrowing; it’s about building a solid reputation and trust in the business world.

Building and Sustaining a Strong Intelliscore

To harness the power of a robust Intelliscore, you should focus on:

- Timely Payments: Always paying your suppliers and lenders punctually can positively influence your score.

- Monitoring Your Credit Utilization: Keeping your credit balances low compared to your credit limits can reflect well on your credit utilization ratio. Keep in mind that most credit utilization is calculated against the highest credit you have borrowed and doesn’t reflect your actual credit limit.

- Regularly Reviewing Your Credit Report: Stay vigilant about inaccuracies or discrepancies that could adversely impact your score. Sign up for free accounts with Nav or FairFigure to monitor your credit health.

- Expanding Your Credit Portfolio Prudently: Diversifying your credit lines with responsible management can enhance your credit standing over time.

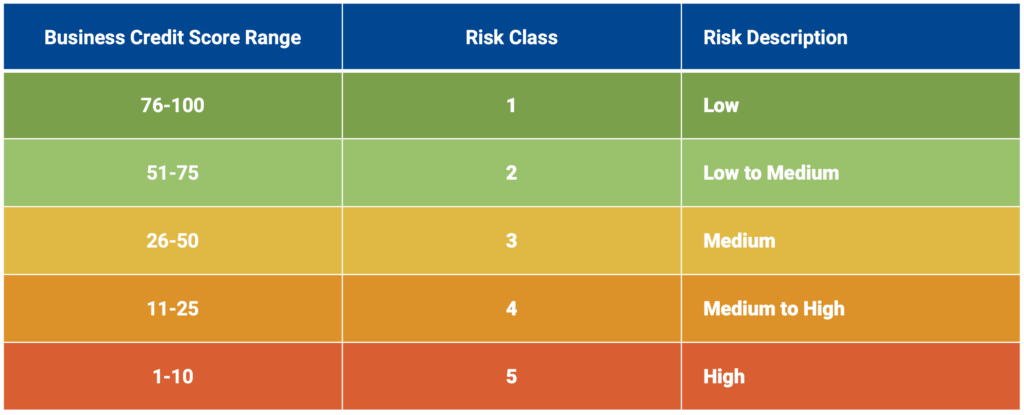

Breaking Down the Ranges

Understanding the specific ranges of the Experian Intelliscore Plus can help you determine your business’s credit standing and strategize for improvement. Here’s a breakdown of what each score range typically represents:

- Excellent (76-100):

- Businesses in this range are considered low risk by lenders. An excellent score suggests a strong history of timely payments and prudent credit management. Companies with scores in this bracket enjoy the best financing opportunities, along with favorable loan terms and trade agreements. To maintain this status, continue to manage your debts wisely and keep your financial statements in good health.

- Good (51-75):

- A good score indicates moderate risk and reflects stable financial behavior. Businesses scoring in this range often have a solid credit history, albeit with minor issues or shorter credit histories. While they have access to decent financing and trade options, there’s still room for improvement to unlock better opportunities. Focus on consistent and timely payments to strive for an excellent score.

- Fair (26-50):

- Falling into the fair range suggests a higher risk level. Companies with these scores may experience some problems with credit approval and may be offered less favorable terms. It’s crucial for businesses in this range to improve credit utilization, reduce outstanding balances, and ensure payments are always made on time. Doing so will enhance their credit standing over time.

- Poor (1-25):

- Businesses with poor scores pose the highest risk to lenders. These scores often arise from a history of late payments, legal complications, or poor credit management. Companies within this range face the most challenging financial opportunities, with limited access to credit and unfavorable terms. Strategies to escalate this score include resolving any outstanding public records, paying down debts, and establishing a consistent record of timely payments.

Each score range tells a distinct story about a business’s financial behavior and affects how lenders perceive creditworthiness. By understanding where your business falls within these ranges, you can plan strategically to either maintain or enhance your Intelliscore Plus, opening doors to better business opportunities.

Improving Your Business Credit Score

If your score is lower than you’d like or you are just starting to build there are some steps you should keep in mind. To elevate your score, start by addressing any outstanding debts and establish a consistent record of timely payments, as punctuality is a key indicator of reliability to lenders and suppliers. On time payments have one of the biggest impacts on any credit score. Actively monitor your credit report for inaccuracies or discrepancies, disputing errors that may negatively impact your score.

Additionally, work on reducing your credit utilization ratio by lowering balances relative to your available credit or highest credit used, which can positively influence your overall credit profile. Diversifying your credit types—such as mixing trade lines, credit cards, and business loans—can keep you from being considered as having a “thin file”. Finally, consider building relationships with vendors who report payments to credit agencies, ensuring that your efforts to pay on time are recognized. It is very important that you reach out to your creditor and verify who they report to, ensuring you have reports going in to the buraus that matter. By diligently following these steps, you can gradually enhance your Intelliscore Plus, paving the way for more favorable funding opportunities and business growth.

Grow Your Business with Confidence

At Growegy, we’re committed to equipping small business owners like you. By understanding and improving your Experian Intelliscore Plus, you not only enhance your potential for securing better loan terms but also build trust and credibility with partners and investors. Remember, your business’s financial narrative is your company’s reputation to lenders and investors.

Would you like a customized strategy to improve your Intelliscore Plus and explore pathways for funding? Connect with our team at Growegy, where we offer everything you need—from strategic advice to practical tools— all to accelerate your productivity and elevate your business finances.

Follow Us

Download

© 2020-2026 Growegy. All rights reserved.

Growegy is not a credit repair organization, financial advisor, financial planner, investment advisor, tax preparer, or acting as a fiduciary, as those or similar terms may be defined under federal or state law. Growegy makes recommendations you may find helpful. Growegy reports business tradelines to business credit bureaus. It is up to you to make the final decision about what is in your and your business’s financial interest.